Is Immediate Relief on your Mortgage Worth the Long-Term Cost?

The path to home ownership in Australia keeps getting tougher, forcing buyers and owners to consider flexible loan structures. These options can ease monthly repayments in the short term but come with an important caveat: you’ll pay substantially more interest over the life of the loan. If you’re weighing up a home loan option that defers part of the debt burden to the future, here’s a straightforward look at commonly used structures offering this temporary affordability.

The Real Cost of a 5% Deposit Mortgage

The government's 5% deposit scheme is a fantastic opportunity for first-home buyers, allowing you to enter the market sooner while avoiding Lenders Mortgage Insurance (LMI), which can easily save you $20,000-$30,000 upfront. However, it's important to look beyond this initial saving and consider the long-term trade-offs. Because a smaller deposit means a larger loan, the financial relief of skipping LMI can be quickly overshadowed by the strain of higher monthly repayments and the staggering amount of extra interest you'll pay over the life of the loan.

How to Maximise Your Age Pension

Making the most of the Age Pension isn’t about dizzying formulas or dry legal jargon — it’s about everyday choices that genuinely shape comfort and security in retirement. From turning the family home into an even greater asset, to simple steps like updating how much Centrelink thinks your car is worth, these practical strategies are based on real stories and proven tips that can help retirees enjoy a worry-free retirement, stretch every dollar further, and feel confident about their financial future.

Who Would Your Super Fund Pay?

When you think about your superannuation, you probably focus on growing it for retirement. But have you considered what happens to it if you pass away? It’s a common myth that your super is automatically covered by your Will. In most cases, it isn’t. Your super is held in a trust, and the fund's trustee is responsible for paying it out. To ensure your money goes to the right people, you need to give the trustee clear instructions. This is done by nominating a beneficiary. Let's look at the fundamentals.

Talking to Your Family About Your Will

It's one of those difficult chats we often put off, but talking to your family about your will and estate plan is one of the most important things you can do. It's not about being morbid; it's about being responsible. Having this discussion can prevent future misunderstandings, reduce family conflict, and ensure your wishes are known and respected.

Imparting Financial Habits to Your Children

Teaching children about money is one of the most valuable lessons a parent can offer. It goes far beyond simply giving them pocket money; it’s about shaping their mindset for a financially secure future. By instilling a few core habits early on, you can move beyond basic saving and start building the foundation of a true investor.

August 2025 Market Updates

August 2025 featured a cautiously optimistic global investment climate, with Australia's ASX 200 showing a strong rise driven by solid domestic fundamentals, while the US S&P 500 demonstrated steady resilience after early dips. The Australian residential property market kept growing due to low supply and easing interest rates, with cities like Darwin and Perth leading increases despite ongoing affordability challenges. Inflation in Australia moderated within the Reserve Bank's target range, leading to a cautious interest rate cut aimed at balancing price stability and economic growth. Overall, the outlook signals a measured but positive recovery supported by easing monetary policy and sustained investor confidence, even as global uncertainties and affordability issues persist.

The Basics of Age Pension

The Age Pension is a vital source of income for many Australians in retirement, providing regular payments to help with living costs. Knowing the ins and outs of how it works can make a real and impactful difference to your financial wellbeing.

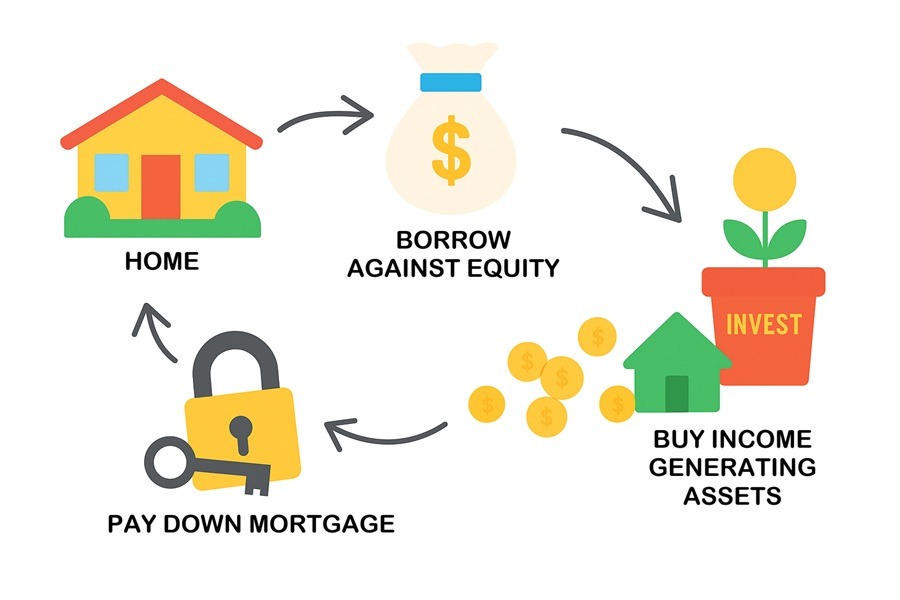

All About Debt Recycling

We're all looking for smart ways to get ahead financially. One strategy you might hear about is debt recycling. It sounds complex, but the fundamental idea is quite simple: you turn your 'bad' debt into 'good' debt. Let's break down what it is, how it works, and the things you need to watch out for.

Cash in the Bank or Shares on the Market?

Deciding where to put your money in Australia can feel like a big decision. Two of the most common options are high-interest savings (HIS) accounts and exchange-traded funds (ETFs). While both can help you build your wealth, they serve very different purposes. Here’s a more detailed breakdown to help you determine which is right for you.

Australian Super Funds Delivered Gains

Superannuation funds delivered gains in the 2025 financial year. Even though there were challenges like global trade tensions and conflicts in the Middle East, super funds not only held steady, but they also delivered impressive returns.

Crafting a ‘Whole Life’ Retirement

When most people think of retirement, a sunny stereotype tends to surface. Think coastal caravan adventures, chasing the grandkids around the park, or leisurely strolls along quiet beaches. It's a comforting image, one that’s replayed in countless superannuation ads and retirement brochures. But what if that dream, while lovely, doesn’t quite capture the full picture? What if ticking off that final workday and securing the right savings target isn’t the last step but merely the beginning of something far more profound?