Newsletter – March 2025

The Share Market

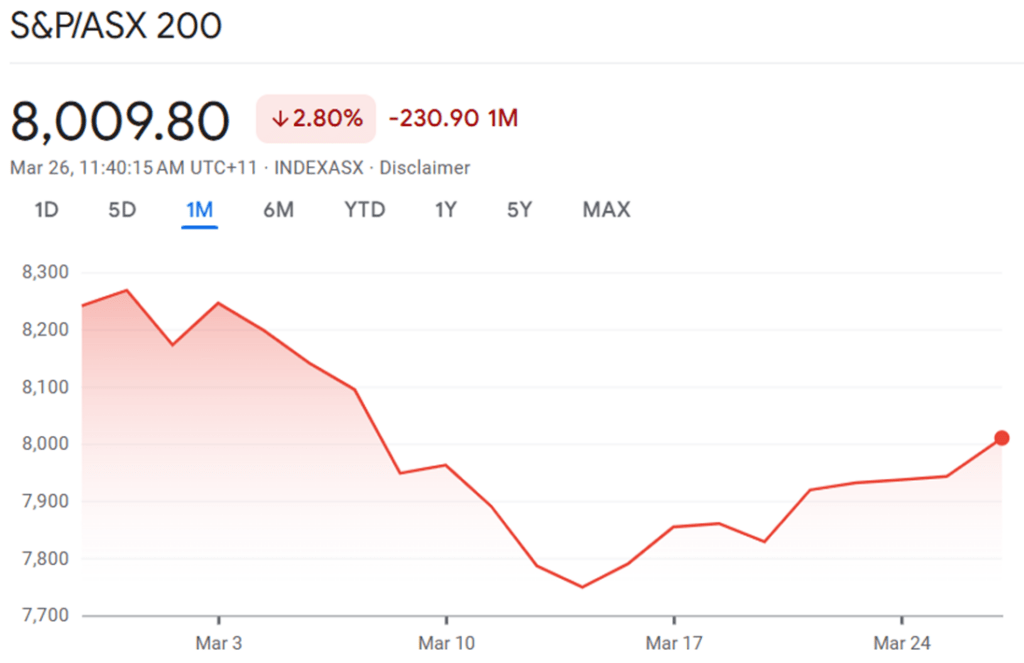

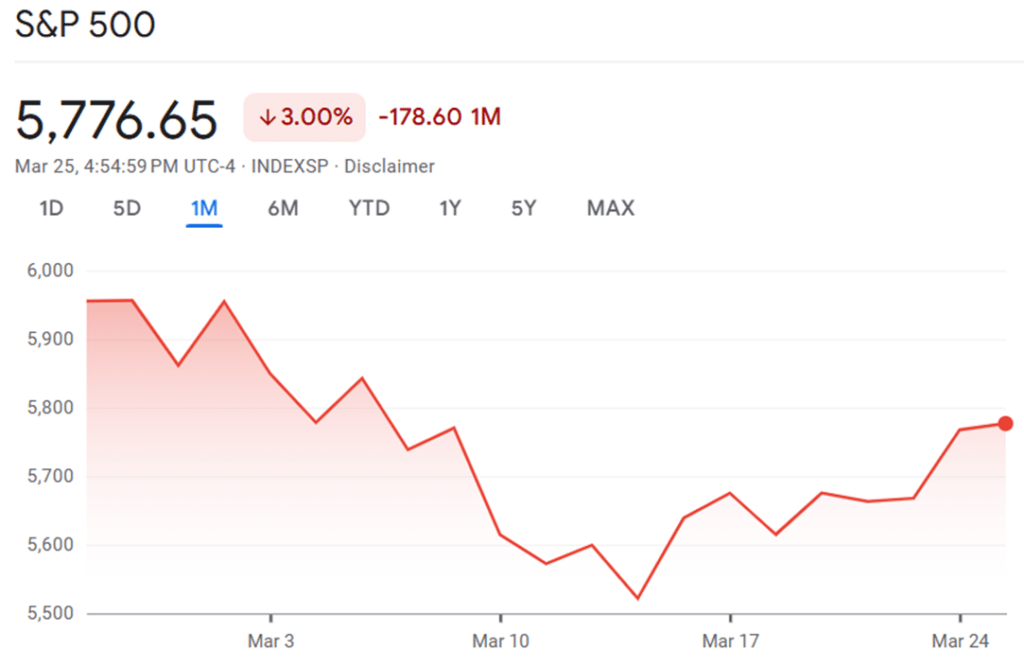

The month of March 2025 has proven to be a period of significant volatility for both the Australian and US equity markets. The S&P/ASX 200 is currently trading at 8,009.80 points, showing a monthly decline of 2.80% or 230.90 points, while the S&P 500 has experienced a similar downward trajectory with a 3.00% drop to 5,776.65 points. Both indices have followed remarkably similar patterns throughout March, characterised by sharp early-month declines followed by gradual recoveries toward month-end.

The ASX 200 began March 2025 trading above the 8,250 level before embarking on a steady descent that intensified in the first half of the month. This downturn gained momentum as global markets reacted to intensifying trade tensions and shifting domestic economic indicators. By mid-March, the index had fallen to approximately 7,750 points, representing a significant correction from its early-month levels. This decline marked the fifth consecutive negative session for the index as of March 13.

The mid-month trough around March 13-15 found support in the 7,730-7,740 range, creating what analysts identified as a potential foundation for recovery. Indeed, the second half of March has witnessed a determined climb upward, with the index recovering nearly half of its earlier losses. By March 21, the ASX 200 was trading at 7,957 points and was poised to snap a miserable four-week losing streak. This recovery was partly fuelled by the absence of new tariff headlines and encouraging February labour force data that reinforced expectations of a potential Reserve Bank of Australia (RBA) interest rate cut in May.

A noteworthy contributor to the late-March recovery was the supermarket sector, following Australian Competition and Consumer Commission (ACCC) findings that concluded major retailers Woolworths and Coles should not be forcibly broken up. This news triggered substantial gains, with Woolworths surging 5.1% to $29.58 and Coles rallying 3.5% to $19.20 on March 21. The strength in these consumer staples provided important ballast to the broader market during an otherwise challenging period.

The release of the Australian Federal Budget on March 25, 2025, by Treasurer Jim Chalmers has added another dimension to market considerations. The budget included several significant funding allocations that could impact various sectors in the coming months. On Wednesday, March 26, the ASX 200 rose 0.7% or 53.7 points to 7,996.20 in early trading, briefly surpassing the 8,000 mark for the first time in two weeks. This upward movement was supported by a positive finish in New York and traders' expectations that the budget would have minimal impact on potential interest rate cuts.

Whilst the full market reaction to the budget is still unfolding, initial responses suggest investors were largely prepared for the announcements. The modest upward movement in the ASX 200 in the final days of March indicates that the budget did not contain significant surprises that might have disrupted the recovery trajectory. However, the fiscal outlook will likely continue to influence sector-specific performance in the coming weeks as investors digest the full implications of the government's spending priorities and economic forecasts.

The S&P 500 has followed a remarkably similar pattern to the ASX 200 during March 2025. Beginning the month near 5,950 points, the index experienced a sharp decline that accelerated in early March. By March 13, the S&P 500 had officially entered correction territory, defined as a 10% drop from its most recent peak. This pronounced sell-off was primarily triggered by US President Donald Trump's introduction of new tariffs on trading partners, which sparked fears of a potential global trade war.

Market anxiety intensified when President Trump acknowledged that there could be a "period of transition" after the tariffs were implemented, which many investors interpreted as a tacit admission that economic disruption was expected. This contributed to the steep mid-month decline that saw the index bottom out around 5,500 points, representing one of the sharpest corrections in recent years.

The second half of March has witnessed a notable recovery effort, with the S&P 500 climbing approximately 2.64% from its March 13 trough. This rebound gained momentum following the US Federal Reserve's decision to leave interest rates unchanged, which helped calm market nerves and restore some confidence in the economic outlook. By March 25, the index had recovered to 5,776.65, though still showing a 3.00% decline for the month.

The volatility has prompted high-profile market analysts to reassess their outlook. Goldman Sachs, which had previously forecast the S&P 500 to reach 6,500 points by the end of 2025, has revised its expectations downward in response to the changed economic conditions. This adjustment reflects growing concerns about the potential impact of trade policies on US corporate earnings and economic growth more broadly.

Trade tensions have emerged as the dominant influence on both markets during March. The introduction of new US tariffs had immediate ripple effects across global markets, with Australian sectors particularly vulnerable to export disruptions showing pronounced weakness. The correlation between the two indices also reflects the significant presence of multinational corporations on both exchanges, whose earnings are directly affected by changes in global trade conditions.

Conclusion

March 2025 has been a month of considerable volatility for both the ASX 200 and S&P 500, characterised by sharp early declines followed by meaningful but incomplete recoveries. The 2.80% monthly decline in the ASX 200 and the 3.00% drop in the S&P 500 reflect investor concerns about global trade tensions, though the late-month rebounds suggest a degree of resilience in market sentiment.

The Australian Federal Budget announcement has added another factor for local investors to consider, though its initial impact appears relatively measured against the backdrop of broader global concerns. As March draws to a close, market attention will likely remain focused on trade policy developments, central bank statements, and key economic indicators that might provide clues about the direction of both economies.

For investors, the parallel movements of these major indices serve as a reminder of the globally connected nature of modern financial markets and the importance of maintaining a broad perspective when assessing market risks and opportunities. The coming months will reveal whether these March patterns represent a temporary correction or the beginning of a more significant market adjustment.

The Residential Property Market

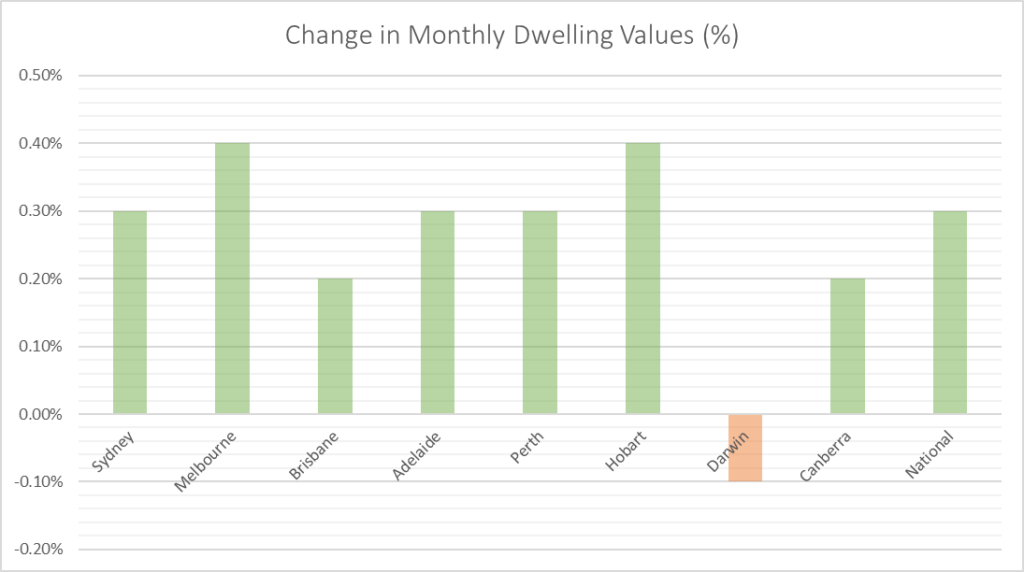

Australian housing markets have shown signs of recovery in February 2025, with values rising 0.3% nationally after a brief three-month downturn. This improvement appears to be driven by expectations of interest rate cuts and improved buyer sentiment rather than immediate changes in borrowing capacity. Melbourne and Hobart emerged as unexpected leaders in monthly growth, while previously strong performers like Brisbane, Perth and Adelaide experienced more modest gains. The rental market continues to moderate from previous highs, though still growing at twice the pre-pandemic average rate.

Housing Downturn Reverses with Broad-Based Recovery

The Australian residential property market has experienced a noteworthy shift in February 2025, with the CoreLogic national Home Value Index posting a 0.3% rise. This increase effectively breaks the short-lived downturn that lasted just three months and had pulled the national measure of home values 0.4% lower. The recovery was widespread, with nearly all capital cities and regional areas recording monthly gains, indicating a potential turning point in the market.

Melbourne and Hobart led the capital cities with both markets increasing by 0.4% in February. For Melbourne, this upturn is particularly significant as it breaks a streak of ten consecutive months of falling home values. This suggests that even markets that have been underperforming may now be finding their footing in the changing economic environment.

Interestingly, the previously strongest performing markets—Brisbane, Perth, and Adelaide—have recorded more modest gains between 0.2% and 0.3% for the month. This shift in momentum indicates a potential rebalancing across Australian property markets, with previously underperforming areas now showing stronger relative performance.

Premium Markets Leading the Recovery

A notable trend in February's data is that the return to growth across Sydney and Melbourne is being driven primarily by the premium end of the market. Upper quartile house values are leading monthly gains in both cities after these high-value markets had previously recorded the sharpest declines. This aligns with previous research indicating that premium housing markets in Sydney and Melbourne typically respond most sensitively to interest rate adjustments.

CoreLogic's research director, Tim Lawless, attributes the improved housing conditions more to improved sentiment than to any immediate enhancement in borrowing capacity. "Expectations of lower interest rates, which solidified in February, look to be flowing through to improved buyer sentiment," he noted. This is further evidenced by improvements in auction clearance rates, which have risen back to around long-run average levels across the major auction markets.

Regional Markets Continue to Outperform Capital Cities

Regional housing markets maintained their stronger growth trend compared to capital cities in February. The combined regional index rose 0.4% over the month and 1.0% over the rolling quarter, compared to the 0.3% monthly rise and 0.4% quarterly decline seen in capital city values. This continues a pattern of stronger performance in regional areas that has been evident throughout much of the post-pandemic period.

However, there has been some variation in these trends, with Sydney, Melbourne, and Hobart now outpacing their regional counterparts in monthly growth. This suggests that the balance between capital city and regional markets may be shifting slightly as the recovery progresses.

Supply factors also appear to be supporting the improved market conditions. The flow of newly advertised listings across the combined capitals was tracking 4.7% lower than a year ago, and 1.5% below the previous five-year average. While total advertised supply levels are almost 1% higher than a year ago, they remain 7.9% below the previous five-year average. This reduced flow of fresh stock to market could be creating some upward pressure on prices, particularly if buyer activity is increasing with improved sentiment.

Rental Market Shows Seasonal Strength but Continued Moderation

The rental market has displayed a seasonal uptick with national rents rising by 0.6% in February, marking the strongest monthly gain since May 2024. However, this remains well below the 0.9% rise recorded in February 2024 and the 1.2% gain seen in February 2021 at the height of the rental boom.

On an annual basis, the slowdown in rental growth is more apparent. Nationally, rents rose by 4.1% over the 12 months to February, the slowest annual gain since March 2021, though still about double the pre-pandemic decade average of 2.0%. This moderation in rental growth is attributed to normalising net overseas migration and a trend towards larger household sizes, factors that have helped ease rental demand pressures.

The most significant slowdown in annual rental growth has occurred in Darwin, where house rents had previously boomed during the pandemic with a peak annual growth rate of 25.0%. The yearly change has now slowed dramatically to just 1.4% over the 12 months ending February. Similarly, substantial moderations in rental growth have been recorded across the unit sectors of Sydney, Melbourne and Brisbane, with annual growth rates dropping from peaks of 15-18% to around 3%.

Some cities have experienced a pickup in rental growth relative to a year ago, albeit from generally weak conditions. These include Hobart, Canberra, and the Darwin unit sector. Gross rental yields have lifted slightly over recent months, rising from a recent low of 3.65% nationally to 3.72%, reflecting that rents have been rising faster than house values since October 2024.

Market Outlook

While housing markets appear to have moved past the recent downturn, the recovery path seems likely to vary significantly across regions. The current rate-cutting cycle is very new and is expected to be drawn out rather than rapid. Financial markets are anticipating the cash rate to reach around 3.55% by the end of 2025, suggesting only two more twenty-five basis point cuts this year. Most economists project up to three more cuts, which would take the cash rate to 3.35%, still well above both the pre-pandemic decade average of 2.55% and the RBA's estimated 'neutral cash rate'.

Tim Lawless suggests that "Until home loan serviceability improves more substantially, it's hard to see housing markets moving into a material growth trend". However, markets that have experienced more significant downturns could be positioned for stronger recovery due to their renewed affordability advantage. Hobart (-11.9%), Canberra (-7.1%) and Melbourne (-6.4%) have recorded the most substantial declines from their recent peaks and may benefit from this relative affordability.

The supply-demand dynamic varies considerably across markets. Based on listing counts to February 23, inventory levels remain elevated in Sydney (+6.9%), Melbourne (+3.9%), Hobart (+25.2%) and Canberra (+6.8%) relative to the previous five-year averages. These regions, where prices remain below their recent peaks, may offer better opportunities for buyers. In contrast, Perth (-28.0%), Adelaide (-33.9%) and Brisbane (-21.5%) continue to face very low levels of homes available for sale, creating more competitive conditions for buyers.

A further lift in consumer sentiment would likely support increased purchasing activity, as historically there has been a close relationship between consumer sentiment measures and home sales volumes. While sentiment readings have risen substantially over the past six months, the trend has flattened in recent months. If sentiment returns to more optimistic levels, combined with the modest improvement in serviceability from rate cuts, buyer activity could strengthen further.

Looking forward, the pace and breadth of recovery will likely depend on the timing and extent of interest rate cuts, changes in consumer sentiment, and regional supply-demand dynamics. Markets that have experienced larger downturns may offer better value for buyers and potential for stronger recovery, while supply constraints in markets like Perth, Adelaide and Brisbane could continue to support price growth in these areas.

The property market's response to these changing conditions will continue to unfold throughout 2025, with the current indicators suggesting a generally positive but measured outlook for Australian residential property.

Inflation and Interest Rates

Australia has seen significant shifts in inflation and interest rates, with the Reserve Bank of Australia (RBA) making its first rate cut since 2020. The cash rate now stands at 4.10%.

The Australian Bureau of Statistics (ABS) released its latest official inflation data for February 2025. The monthly Consumer Price Index (CPI) indicator showed an annual increase of 2.4% for the 12 months leading to February 2025. This figure indicates a continued moderation in the rate of price increases compared to higher levels experienced in previous periods, suggesting that the RBA efforts to curb inflation through interest rate adjustments are having a discernible effect. Excluding volatile items and holiday travel, the annual increase was 2.7%, with the annual trimmed mean also at 2.7%. Electricity prices saw a significant decrease of 13.2% in February 2025, likely due to government energy rebates. Consumer inflation expectations showed some divergence, with the Roy Morgan index at 4.9% for the week of March 17-23, 2025 , while Trading Economics reported a lower expectation of 3.6% in March 2025, the lowest since October 2021

As of March 2025, the official cash rate set by the RBA was 4.10% , following a 0.25% decrease on February 18, 2025. This reduction comes as a response to easing inflation, slower economic growth, and reduced wage pressures, signalling a stabilisation of the economy after a period of elevated interest rates. RBA Governor Bullock indicated that future rate cuts were not guaranteed. Market expectations, based on ASX futures, suggested an 8% probability of another rate cut in April 2025 . Major banks anticipated further rate cuts throughout 2025, potentially bringing the cash rate down to around 3.35% by year-end.

The Federal Budget for 2025-26, announced on March 25, 2025, projected a return to deficit, forecasting an underlying cash deficit of $27.6 billion for 2024-25, widening to $42.1 billion in 2025-26 . Gross government debt was projected to reach $1.22 trillion by 2028-29.

The Budget, amongst other items, includes a one-off 20% reduction in HELP debts, aiming to alleviate financial pressures on graduates and potentially increase disposable income. This measure, coupled with personal income tax cuts scheduled from July 2026, reflects the government's strategy to stimulate consumer spending and support economic growth. However, these initiatives contribute to the projected budget deficit, highlighting the delicate balance between fiscal stimulus and maintaining sustainable public finances.

Additionally, the extension of the $75 quarterly energy rebate until the end of 2025 is expected to provide continued relief to households facing energy cost pressures. While this directly reduces certain components of the CPI, the broader impact of increased government spending on inflation remains a point of consideration. The RBA will need to monitor these developments closely, as the interplay between fiscal policy and monetary policy will be critical in steering the economy towards stable growth without reigniting inflationary pressures. The budget deficit and spending initiatives are expected to influence aggregate demand. While increased spending can lead to demand-pull inflation, measures like energy rebates directly lower CPI components. The increased deficit implies more government borrowing, potentially putting upward pressure on longer-term interest rates. Tax cuts and student debt relief could indirectly boost spending and potentially influence inflation.